Specifically used this 12 percent club for bharatpe p2p lending

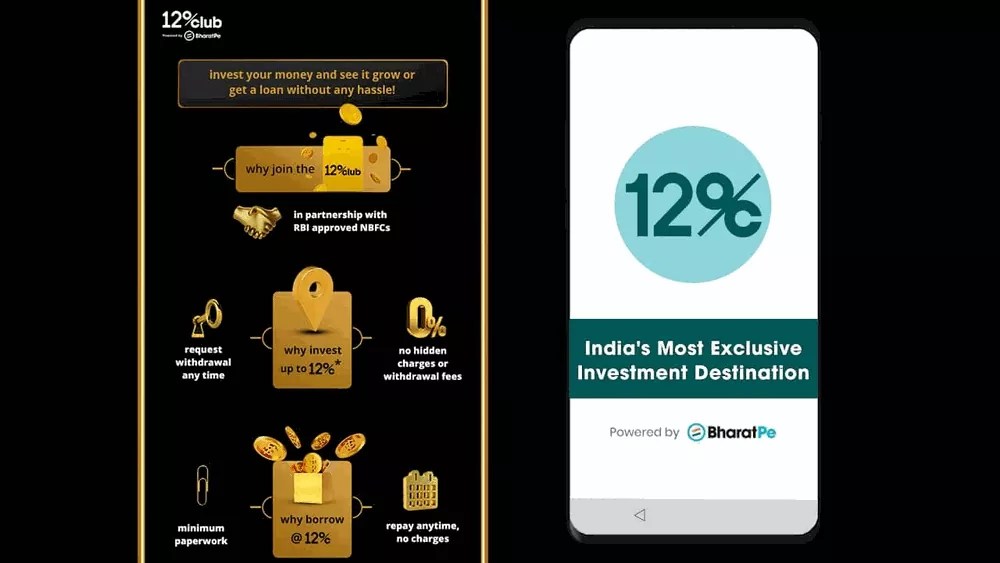

They are paid The 12 percent club app, which enables investors and borrowers to borrow money, is administered by BharatPe. The 12 Club bharatpe p2p lending platform is one of India's leading Fintech firms. You might make at least 12% interest on your investment if you invest at 12%.

Peer-to-peer lending firm 12 Club bhratpe expands with the release of its product. The game is aimed at consumers and investigates the financial services and merchant payments industries.

Thanks to BharatPe p2p lending and the 12 percent club app, individual investors will be able to borrow money at 12% interest.

Start earning up to 12% interest on your investments! Download Now

Liquiloans are now recognised on the Club BharatPe p2p lending network as a component of the client solution that LenDenClub and Club BharatPe jointly created. Through the same partners in 2019, the fintech company provided peer-to-peer loans to its merchants.

To keep delinquencies at a minimum, P2P investors would provide loans to its merchants on the 12 percent club app platform.

The company claimed that because these stores take payments through the BharatPe system, it will be able to analyse these loans more completely using corporate cash flows. The company also disclosed that a little amount would be deducted from daily reimbursements to help pay off this debt.

By offering loans to its customers, reputable non-financial organisations like Hindon Mercantile would encourage borrowing on the 12 club bhratpe p2p lending.

12% club bharatpe p2p lending had first Started

Without taking on the major risks connected with investing in stocks, we think the 12 percent club app is a smart choice. We soft launched the product earlier this month. Additionally, Members are free to decline the offer at any moment. Since bhratpe p2p lending has millions of merchants, concentration when lending to a small cohort is not a problem.

The normal loan period on the platform, according to Grover, will be between three and twelve months.

Private investors currently provide the 12 percent club app $5 million a month, and loans totaling $1 million have been made.

Referrals have accounted for the majority of the growth, but the company estimates that the programme receives close to

enter the highly sought-after unicorn league in India with a $2.85 billion value.

Tiger Global Management, a new investor from New York, led the $370 million primary and secondary investment round for 12% Club Bharatpe P2P Lending.

What is P2P lending?

- 12% club bharatpe p2p lending lending is not a new feature.

- In 2017, the Reserve Bank of India had brought this service under its regulatory purview.

- Even at the time. There were more than 20, 12 P2P lending players in the market but RBI’s regulations ensured only the serious ones with watertight business models remained in the sector.

- In p2p lending, users sitting on idle money provide loans to potential borrowers identified by the service provider.

- These 12% club bharatpe p2p lenders then receive payments from the borrowers on a set basis — either one time or in equated monthly instalment.

- After RBI issued its regulations in 2017, the space saw a spree of fundraising

- bhratpe p2p lending Involving some of the existing players in the segment.

- Some of the major companies operating in this space include RupeeCircle, Finzy, IndiaMoneyMart, etc.

Start earning up to 12% interest on your investments! Download Now

What are the risks?

- One of the biggest risks associated with this kind of lending is the non-repayment of loans.

- Given that 12% club bharatpe p2p lending is a form of unsecured loan. In case of a default there is no guarantee put up by the borrower for the lender to redeem

- However, the unsecured nature of the loan is also the reason behind the high return on investment.

Start earning up to 12% interest on your investments! Download Now

About Bharatpe p2p lending?

- “Consumers on the 12 club can invest their savings anytime by choosing to the lend money through partner

- Additionally, a consumer can avail collateral free loans of up to Rs. 10 lakh on the 12 % for a tenure of 3 months, as per their convenience, the statement said.

- There will be no processing charges or pre-payment charges on the consumer loans,

- The loan eligibility would be determined by various factor, so it also added.

- Including consumer’s credit score, shopping history using Payback loyalty system or the payments done via BharatPe

- Consumers investing via app can put in a request to withdraw their investment anytime, partially

- Or completely, without any withdrawal charges.

- At present, the upper limit for individual investment is Rs. 10 lakh.

- This would increased to Rs. 50 lakh over the next few months.

Start earning up to 12% interest on your investments! Download Now

Conclusion

A prime example of the cutting-edge services that financial technology companies want to offer is the introduction of Bharatpe P2P lending by 12%club. By allowing people to earn money and borrow money at rates that are competitive with the market, you can keep captive audiences within the ecosystem.

Comments

Post a Comment